A Simple Money Plan So You Can Stop Stressing and Start Living

You make money but it still feels confusing, stressful, or out of control. We help you build a simple plan so your money finally works for you.

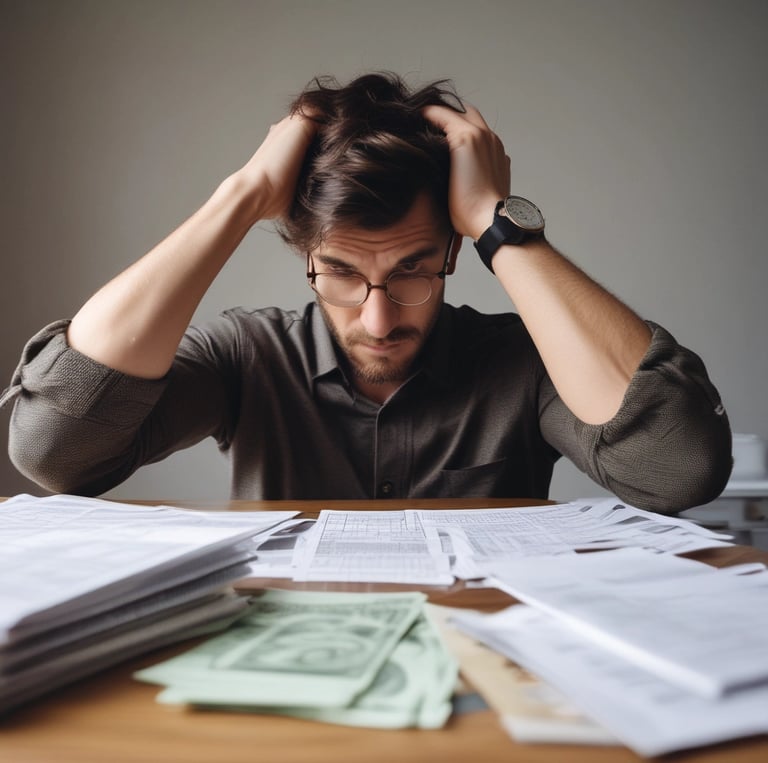

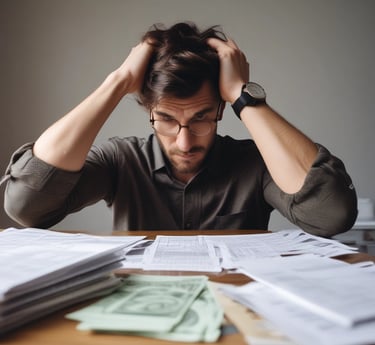

If Money Feels Stressful, You’re Not Alone

You might feel like you’re doing everything “right,” but still wondering, “Where did my money go?”

Budgeting feels overwhelming.

Credit cards stress you out.

You feel behind everyone else financially.

And you’re thinking, “I don’t even know where to start.”

Your Personalized Path to Financial Clarity

We guide you with a simple, personalized money plan—starting with a free call, a 3-month financial audit, and a step-by-step roadmap.

No judgment. No jargon. Just clarity.

As sons of immigrants, we believe financial literacy should be accessible to everyone.

Our Services

Tailored financial guidance to build your budget and credit confidently.

Budgeting

A realistic budget that fits your life and puts you in control of every paycheck

Credit Card Management

Use credit cards strategically to build credit and earn travel rewards without debt traps

Your custom financial plan breaks everything into clear, doable steps—so you always know what to do next.

Get a Plan You Can Actually Follow